The end of retail as an economic model

White paper written in 2012

Traditionally, retail means buying large quantities at a discount and selling them per piece with a profit.

Today, this model has lost its added value, since one can ship goods and products straight from the factory to the end consumer.

High fixed costs (pricey mall real estate, store fixtures, cashiers and sales associates) added to investments in inventory, are putting every multi- brand store in a vulnerable position.

For brands this means that they risk losing their most valuable partner: the traditional retailer.

White paper by Jean-Pierre Bobbaers Founder – Strategic Director IMAGINIF

Why This Paper ?

In my 25 years as a retail consultant and designer I have been constantly searching for new ways to help my clients.

The new store concepts, including related communication, that we create will of course bring more profit. However in the current economic and social situation it has become much more than just a design challenge.

For the last years, I have observed that clients are chaotic in their decision-making. They jump on every new trend: they hire new online marketing services, create their own online store, launch themselves on Facebook and Twitter… with or without results.

New strategies are implemented and then changed with a finger snap overnight by newly appointed managers, who in some cases even lurk around for a bonus at the end of the quarter. Just like a trainer in the football business or a dealer in the banking sector (we all know where that has brought us). The result, chaos and in many cases closing the factory or stores or in the worst scenario: bankruptcy.

My scope is European, but this paper is certainly relevant for brands and retailers in other regions as well. Below are some examples to help shed more light on the current situation.

Producer brands that rely on multi-channel and multi-brand retailers in the physical world such as Levi’s, Eastpak, Fatboy, Oakley and many others have opened their own online store. In some cases offering personalization services, something that the physical retailer cannot offer. What does the physical retailer think about that? I am even more

curious to know what these brands want to achieve? A war? What is their long-term strategy? Do they even have one?

In recent years multi-brand retailers such as

Mediamarkt, Fnac and Carrefour have opened their

own web store. So what? Do they not realize that

they are driving their customers even further online and that their competitor or supplier web-shop is now only one click away and not a 15-minute drive?

The German fashion brand Hugo Boss recently decided to withdraw their premium collection from the online retailer Zalando since it was not in-line with their brand values. Are these the first signs of a re-shuffling of the cards?

The German home appliances brand Miele is selling washing powders and accessories online. Is this more than just a simple strategy to get their customers’ profiles and credit card numbers?

Apple is often praised in articles and seminars when talking about ‘how to do it right’. But isn’t that just thanks to the dictator Steve Jobs who always ensured that there was a consistent price and brand strategy across all distribution channels?

How many CEOs today dare to be a dictator like he was?

Tesla, the US electric carmaker, decided to have a distribution system of their own, neglecting multi brand US car dealers. The result: a court case from the National Automobile Dealers Association (NADA). They also claim distribution rights (They have lost the court case for the time being). Next, BMW announced that they would follow Tesla by selling cars directly over the Internet. The Result? Protest from German car dealers, of course.

I recently confronted a local independent optician regarding the online business of Oakley, Ray-Ban and the commercials of a Dutch chain that offers three pairs of glasses for the price of one. I asked “how are you are going to deal with that?” his answer was “we offer an experience.”. What experience, a coffee, help when choosing…?

In Flanders, Belgium, the government wants to help independent retailers in setting up their own web-shop. Should the small retailer now also compete online with the big chains and big producers brands? How are they going to pay for this? After all, the investment of a website with one customer per day compared with that of a thousand is the same.

Online retailers such as Zalando, Coolblue and Amazon have started to open physical stores. You start to wonder if the online experience alone is enough?

A recent study on the presence of Belgian retailers on social media shows that they are all there, but no real conversation happens, just a few promotion announcements. What’s their strategy, given the investment of consultants, maintenance and staff?

Independent travel agencies no longer receive a discount on flight tickets they book for their clients. They need to add a premium themselves. How can they survive?

The French government intends to tax Amazon.com in order to protect their national bookstores. Isn’t that mere protectionism?

A store in Australia has been leaving mailings in the mailboxes of residents saying “we will charge 5$ for just looking”, this money will be deducted from their bill if they purchase an item in the store. That’s how far a retailer can be driven (close to insane) because of the “showrooming” trend.

The list goes on but I think that my point has been made clear.

In my opinion this behavior is driven by fear. The fear of competition, both on- and off-line. Add to that a well-informed, connected consumer and you have a recipe for disaster.

I have analyzed hundreds of articles, including white papers from top consultant firms. But the problem with the big management-consulting firms is: they never question the economic model. The only thing they do is to help companies become better at the same losing game. They help sustain the war between retailers and brands whilst they continue to invoice both sides. Just like in a real war, it destroys real estate, factories and even more importantly it creates innocent victims: the employees together with the customers.

This isn’t the way to go on.

For decades producer brands have been down on their knees in front of the retailer giants, this is going to change. Now they are starting to sell directly, therefore crushing the power of the traditional retailer.

I have realized that just helping a client with a new website, store design or social media presence is not a solution. We need to establish the overall strategy first. I have talked with clients and colleagues in the retail business as well as directors of new media companies. I have attended seminars, had chats with clients and friends in 4 continents and last but not least I have talked with people on the street.

What I have come to realize is that I need to start at the beginning, the history, the definition of the vocabulary used in my business, just basic rethinking!

This white paper offers insights and directions for solutions.

Definition of a retailer The end of retailing as we know it

Back in 1998, Nicolas Negroponte (Founder M.I.T.) stated: “Any business you can turn digital, will have global competition.”

He went even further by predicting the end of retail, as we know it.

That was fifteen years ago.

Today, traditional multi-brand retailers are fighting their Napoleonic war on multiple fronts, trying to provide quality to the smart connected consumer and competing on price with online players. Retail comes from the old French word “tailler”, which means, “to cut off, clip, pare, divide” in terms of tailoring (1365). It was first recorded as a noun with the connotation of a “sale in small quantities” in 1433.

The basic economic model used by retailers was based on buying large quantities as cheap as possible, bringing it to their own stores and selling each piece as expensively as possible. The advantage for the consumers: they didn’t have to make the search and/or the trip to the factories themselves.

For the last hundred years, this model has known many different formats by which retailers wished to stand out from the competition: department stores, specialty stores, discount stores, the online store… but they all continued to be based on the same economic principal of buying considerable volumes of cheap stock, and selling

it at prices as high as possible.

This business model has come to an end.

Why?

High fixed costs (rent, personnel…) added to investments in inventory, are putting every multi- brand store in a vulnerable position. What’s more, the list of investments and costs in this business model keeps on growing.

For the last ten years, most multi-brand retailers have invested in new services and communication tools, like their own repair service, a help desk, staff training programs, websites, and recently the obligatory Facebook page and presence on Twitter.

To withstand competition they also need to invest in branding in and outside the store, something that is not in their DNA (bearing in mind the low cost purchase – high-priced sales model). And they have to do all this in a market driven by a well informed, demanding and Internet connected consumer. At the end of the day, it just doesn’t make sense to have stockpiles with all the variety of colors, sizes and models lying on shelves.

There must be a better model.

Brands Need Retailers

Consumers want it ALL, EVERYWHERE and they want it NOW.

Brand is the “name, term, design, symbol, or any other feature that identifies one seller’s product distinct from those of other sellers”. The word brand can refer to a retailer or a manufacturer of goods or services. In the world of retailing it mostly refers to the latter: companies that design and produce their own goods/services.

For the sake and clarity of this paper I will refer to these specific brands as producer brands.

Producer brands can have their own stores, such as H&M, Ikea or Nespresso.

There are also producer brands with a multi- channel approach, such as Apple or Eastpak. These companies invest heavily in branding and advertising. Considering the fact that the current retailing model is under pressure, as explained before, they need to make choices. The multi- channel brands are about to face a future in which they have to make giant strategic decisions.

In the current retail business model, producer brands are constantly in a negotiation situation with the retailer, negotiating constantly on price. The price depends on volume combined with support in promo, advertising and/or sponsoring store design. A better store and shelf presence in return is part of that too.

Strong producer brands have the luxury of picking their multi-brand retailer, based on different factors that suit them. Sadly for the consumer, they will often prefer the retailer with the highest turnover and not necessarily the retailer with the best customer or brand experience.

Most producer brands supply online stores as

well, therefore creating friction between their multi-brand retailers.

Worst-case scenario: they start with online sales themselves and start competing with their own clients.

This situation cannot hold.

Why?

Consumers want it ALL, EVERYWHERE and they want it NOW.

Considering the fact that the multi-brand retailer is facing high fixed costs and therefore – in most cases – is not able to comply with a well informed, demanding, internet connected consumer, more and more customers will be unhappy or confused with their purchase and the (wrong) product.

Their local multi-brand retailer cannot offer them the whole range of a brand, consumers lack pre- sales information in this store as well. They realize they pay too much and start shopping online. However: on the Internet they face the absence of pre- and after sales support.

Brands need to realize that they put the retailer in a “cannot hold” situation.

Two things will happen: increasingly unsatisfied customers will give up on their brand, and more and more retailers will drop out.

As a result, brands will suffer image damage and a loss of physical brand presence.

Brands need retailers!

Introducing the BrandTailer

What is a BrandTailerTM?

It is a producer brand that controls the complete customer experience journey from beginning to end.

It designs and produces its own assortment; it manages its own branding and marketing communications; it has full control over its distribution channels; it owns the customer relationship before, during and after the purchase.

We drop the RE in REtailer, since there is no added value in the buying low – selling high model of the past. There certainly is no added value in stocking large quantities. All different sizes, colors, models don’t necessarily need to be present in the store. Instead, we focus on the value of the brand and customer experience. Brandtailers cut out the middleman.

They are capable of offering an excellent shopping experience to the customer before and throughout the sales process.

These Brandtailers have a direct link to their touchpoints. They can give their staff the best training, since they directly employ them. They know their customers by name and age, they know what they have bought, and they know what they need. They should be committed to excellent customer service in return.

Today’s and more importantly tomorrow’s technology will give them unlimited possibilities to have a conversation with their audience and build a real ongoing relationship.

Brandtailers can do this in two ways: they can run their own store network (mono-brand stores, possibly through franchising partnerships) or they can partner with multi-brand retailers in a new kind of business model.

The BrandTailorTM Store

A new generation of retailers

Brand-owned mono-brand stores are nothing new to the world, even if they are changing today with the help of modern technology.

Brands can open large stores at heavy traffic locations, and run small ones with a more limited range of models, colors and sizes in stock where, with the help of touchscreen kiosks or tablets and simple and clever presentation techniques, the seller still can show the whole range and satisfy each customer with online, in-store ordering and overnight delivery.

However, not every product is suitable to be offered in a single brand store. Many products need to be presented near other products.

A BrandTailerTM that doesn’t run its own stores, forms partnerships with multi-brand retailers. But this is not a brand-retailer relationship, as we know it. Instead of negotiating on prices, volumes, promotions, the BrandTailerTM pays the retailer to represent the brand. Think of the multi-brand store of the future as a curator of multiple, complementary ‘Instore Flagship Stores’.

These stores become demonstration, information rooms (not showrooms) of different products with a limited stock organized around specific themes. The big challenge for the owner of these new places is create a harmony between the various producer brands. In this concept the BrandTailerTM needs to connect to the multi- brand retailer and give access to all its other

touchpoints, so that shoppers can get the full brand experience and pre-sales info, can order in-store & online and get their desired products overnight delivered. Customers have access to the complete range, color, model, size and so on.

These stores have more possibilities than just being showrooms; they can offer fitting entertainment and enriching learning activities. In this new model, the retailer is rewarded for representing the brand with a monthly fee, combined with a percentage – smaller than usual, but the same as everywhere – on the sales. On top of that, the retailer can gain income by charging the public for activities.

To become a BrandTailerTM and fit the above definition, both multi-brand retailers and producer brands need to change the way they do business. They need to review each other’s roles. They need to re-establish one another’s responsibilities.

Brands need to review their price policy and their distribution channels. They should focus on retail channels that can truly give full brand and customer experience.

Retailers should do the same; they should focus on selling goods of brands that support them to fulfill the customer’s demands.

New kinds of store formats need to be created. Each brand and/or retailer requires a different approach to become a BrandTailer.

Retailers are all different

In my research most articles talk about retailers and brands, sometimes multi-channel brands or multi-brand retailers. It is confusing.

I try to bring an overview and below I discuss their capability to be or to become a BrandTailerTM.

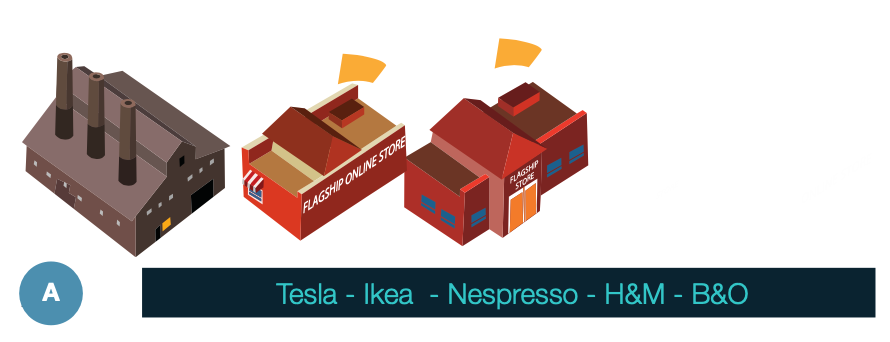

A Tesla – Ikea – Nespresso – H&M – B&O

These brands are the ones that have the ability to control the quality across all touchpoints. They produce their own products and deliver direct to the end consumer. They are brandtailers.

B. Betabrand.com – TailorStore.com – WindowFarms.com

These are the new brandtailers, the micro- multinationals. They innovate, produce and distribute directly to the consumer, worldwide. They have a direct conversation with their audience. This group will grow overtime and has possibilities to open physical stores if necessary.

Apple

This is Apple; they produce their own products and distribute them through every possible channel, in a very controlled way. On top of that they combine their own products with those of other brands to make the experience complete. Every product they sell in their own store is covered by their own service quality. However their Premium dealer network is a challenge for excellent customer service.

D. Decathlon – Carrefour – Gamma

These are stores that challenge premium brands

with their own products/brands. They face the challenge of offering a great experience across all products they sell.

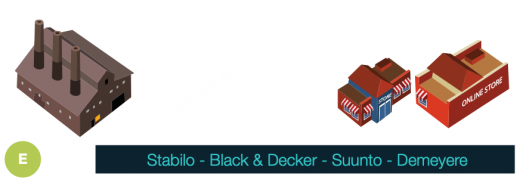

E. Stabilo – Black & Decker – Suunto – Demeyere

This group consists of manufacturers. For them there are enormous possibilities. They could become a BrandTailer by offering the retailers they work with all kinds of tools to better represent their products. In-store ordering is a key element for their future growth. They could be a source for retailers to build a new kind of theme stores or convenience stores with a hundred times more (on-line) SKU’s then today.

F. Eastpak – Swatch – Oakley – Esprit

This is the group that takes it all. They will make the multi-brand retailer not happy since these brands sell directly themselves. Their pricing policy is not clear. Making their network of retailers vulnerable for ‘showrooming’. They need to make choices.

G. Fnac – Vandenborre – Brantano

This group is the largest, these are the real old retailers, they buy low, sell high with little added value for the consumer or producer brand. They face competition from all sites. Price from online retailers and pre- and after sales quality from more specialized stores. They have a lot of work to do.

H . Amazon.com – Coolblue.nl – Zalando.de

These online retailers surf on opportunity, a gap in the current market, without making really profit (yet). Once the big brands have their online strategy sorted out, they will not be needed anymore since they can’t give any added value to the brand experience. A future possibility for them could be to turn themselves into a highly automated logistics company serving the producer brands.

Creating a BrandTailer Store.

Let us translate the theory into practice and present a few inspiring strategic examples.

Supermarket

Local supermarket chains could rearrange their space and become smaller, while at the same time offering far more products. They could have a giant section of different fresh vegetables, combined with a section of easy to carry, fast moving consumer goods (FMCG).

Next to that, they could present digital enhanced “posters” section of heavy to carry, large FMCG goods, that take little space. Also rare spices, vegetables, Belgian chocolates and beers, specific beauty and health care products, you name it, can be sold: clients just scan the barcode and the goods will be delivered at a place and time of choice.

Shipping can be taken care of by the retailers’ distribution center or directly from the producer brand to the customer, creating fantastic convenience and choice opportunities for customers. Rare brands will be happy to support this format!

Of course one can also order on the supermarket’s website but this website differs from the ones we already know: it has the supplier brand’s special website embedded and each conversion, purchase and browsing activity is shared with the brand. The customer can rely on the producer brand’s help desk, which informs the retailer. Consumer, supermarket and producer brand are truly connected.

Home of Cooking

Imagine a place where you go to on a Saturday evening and learn how to cook Japanese. A Japanese chef teaches you how to handle the different ingredients and tools to make a great recipe. At the same time there’s a small Japanese section where you can find some of these ingredients and tools, to be ordered directly together with much, much more from a digital catalogue, presented in a fantastic way. Just around the corner, there are other sections, other kitchens, like Italian or French, each using the same concept. During the week, different events with different themes take place. Oh, and they have opening hours when people have time 😉

Producer brands support this Home of Cooking by sharing

recipes, tools, cooks and once again they interconnect with the retailers website and customers. This goes far beyond the current presentation table with just some stuff to taste in a store. The experience and choices provided for the customer are terrific.

To the brand it means customers get a taste of the full brand experience and the possibility to try before they buy.

The economic model is also different, since the core business of a place like Home of Cooking is edutainment. The brand pays rent to the retailer for taking up space. In return, the usual profit margin for the retailer is lower than usual (but still the same sales price as anywhere else off- or online). But instead he is provided with mind-blowing furniture from his suppliers to entice his clients. It’s like a Micro Flagship Store.

Local school supplies store

Every local store for school supplies has a small range of schoolbags. At the beginning of each school year this section grows. However, no store has enough room to display all the models and to have all the different varieties in stock.

A brand of schoolbags only needs one square meter of furniture to show off all its products!

Imagine this furniture: on the right hand side it contains 5 grey schoolbags of various sizes, some with more or less pockets.

On the left hand side there’s a rack with over 100 textiles grouped by color, pattern and by the latest trendy designs. In the middle: a 27 inch screen which shows the latest brand building videos. There is a bluetooth connection where kids connect their own earphones to listen to it.

They can even copy the movie to their own smart phone. Next, they themselves, or with the assistance of the sales person, choose the right size and pattern on an iPad app, that’s located under the 27 inch screen.

They can even get their name embroidered onto the bag, which will then be delivered to their homes or they can pick it up the next day in the same ‘small’ store.

The benefits, for everybody, are clear. The customer can create his or her own bag; the retailer offers the whole range and saves space. For the brand this Micro-Flagship Store is not only a sales point but also a brand building touch point, building a new and direct relationship with a fan, providing later customer support or just a conversation on Facebook by requesting to become friends.

One more thing; the retailer is also rewarded by the producer brand in the form of a rental fee for the occupying space, since it is in-store advertising.

Conclusion

We used the above quote in 1997 for our company presentation; it is as true today as it was then.

There is little value any more in the RE of the word REtailer.

Selling (brand) and buying (retailer) large quantities and stocking them locally before sales no longer makes any sense.

Instead, it is about connecting with the customer through all touchpoints. This is the only way to create an excellent customer experience.

It’s the ability to respond to whatever the customer desires, wherever they may be, and whenever or however they choose to communicate.

Producer brands need to establish new distribution and price strategies.

They need to build tools that go further than a website or in-store display, they need to offer smart solutions that connect the customer with the retailer across all touchpoints.

Retailers need to review their store format, they need to review their role in a process that goes beyond buying large – selling small; they need to renegotiate their relationships with the brands and ask for a different kind of support that transcends and exceeds price negotiation.

Only then they can promote their own retail brand as being really unique.